How We Help

With our one-to-one appointments and our consultative approach to learning about you and your specific needs, we are sure to find the right insurance solution for you. So, just schedule an appointment and we'll take care of the rest.

Health Insurance is a piece of the puzzle that can be difficult to choose. And having the proper health coverage, with premiums you can afford, that cover the needs of you and your family. Set up a meeting to discuss your options so you can make an informed decision.

What is the best health insurance plan that will best fit your needs:

- HMO (Health Maintenance Organization): Plan limits coverage of care with doctors that are within the plan’s network.

- PPO (Preferred Provider Organization): Plan where you can pay less if the doctor is within the plan network. If choosing a doctor outside of the plan without a referral there is an additional cost.

- HDHP (High Deductible Health Plan): Plan where the deductible is higher and typically with lower premiums.

Medicare is a federal health insurance program that began in 1965, as a result of the “Medicare Act”. This act provides coverage for US citizens who meet one of the following criteria:

- Over 65 years of age

- Under 65 years of age and receiving Social Security Disability Insurance, or SSDI.

- Suffering end-stage renal disease

Medicare coverage is classified under four different categories:

- Part A: Hospital Coverage

- Part B: Outpatient Coverage

- Part C: Medicare Advantage Plans

- Part D: Prescription Drug Plan (PDP)

We specialize in all Medicare-related products that include:

- Medicare Advantage Plans (Part C)

- Prescription Drug Plans (Part D)

- Medicare Supplements (Medi-gap Policies)

There are changes every year in Medicare Plans. At Daisy Benefits we understand these changes and can help explain and educate you on how these changes could affect you.

We work to remove confusion from understanding Medicare and you will have a one-on-one consultation to help compare plans and switch plans with confidence.

Life insurance is used to help provide financial protection in the event of death. It can be used to help protect you, your spouse, children, business, or other beneficiaries.

However, Life insurance can also add value to retirement income. Life insurance can help provide more than just protection. It could also be used to accumulate tax-deferred dollars that provide income options to help supplement your retirement income.

Life insurance may not always be top of mind, but did you know that aside from paying your beneficiaries upon your death, there are more benefits worth exploring? As you prepare for your retirement income, it’s worth exploring how your policy can be utilized as a source of income in retirement to help maintain your lifestyle.

Americans are living longer than ever and as we age; many people may find themselves in need of some extra help with everyday activities. The benefits of long-term care insurance go beyond what your health insurance alone covers by reimbursing you for additional services. Services needed for things to help with injury, illness, and a cognitive impairment that can make it a challenge to care for yourself.

Click here to learn about coverage.

An annuity is a contract with an insurance company that guarantees income during your retirement years.

You may want to consider an annuity if you want guaranteed income in retirement. Annuities can be an option for people thinking about their long-term retirement those nearing retirement who may want income right away.

People consider an Annuity when they are looking to create a stream of lifetime guaranteed income, maximize growth with downside market protection.

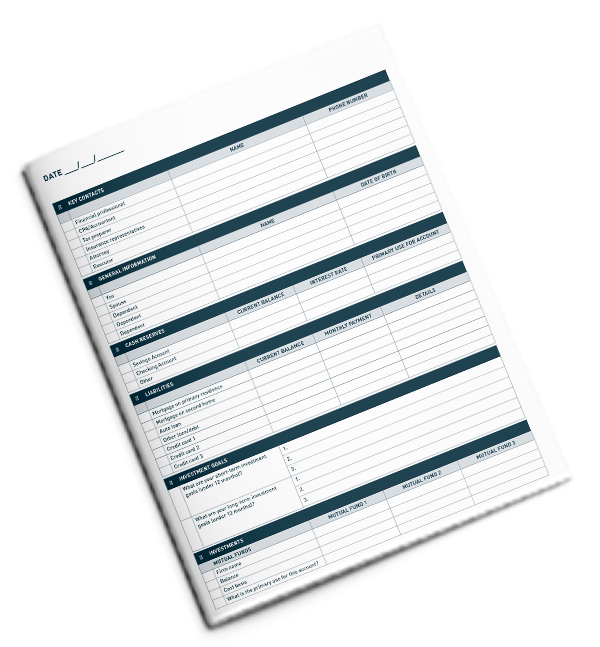

Instant Access

Financial Checklist

Catherine Perkins, Founder

Licensed Insurance Agent in NH, ME, MA

Choosing insurance can be very complex. I provide a consultative service for consumers who need assistance with Medicare, life insurance and other insurance needs. I shop the market to find the best prices and benefits packages available all at no cost to the consumer.

Amanda Alksnitis, Strategic Partner

Wealth Manager*

In 2016, after an eight year career in the banking industry, Amanda became a fully licensed, independent Financial Advisor in NH, VT, ME, MA, RI, NY, MD, VA, DC and FL specializing in investments, college planning, retirement planning, Federal employee benefits, and wealth management. As the founder of Alder Tree Financial, being able to educate a family or individual through life’s financial stages and help them achieve success and wealth has proven to be one of her most satisfying journeys. Amanda believes there is a solution to each financial quest and is honored to assist individuals and families in navigating through this process.

Learn more & visit www.aldertreefinancial.com

What does retirement mean to you?

Retirement isn’t the final chapter in the book of life. But rather, a new beginning.

Contact Us Today

Schedule a one-on-one consultation to review options and select the best solution for you!

or

PO Box 16441, Hooksett, NH 03106

We do not offer every plan available in your area. Any information we provide is limited to those plans we offer in your area. Please contact Medicare.gov or 1-800-Medicare to get information on all of your options.